Table of Contents

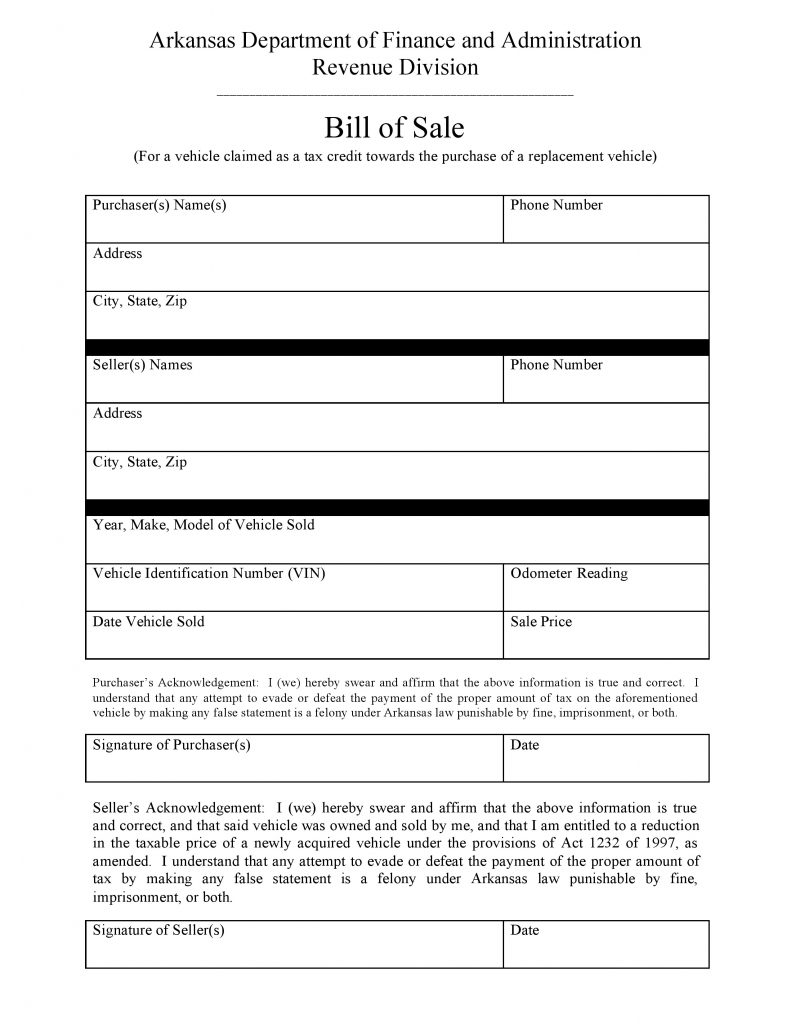

Arkansas Tax Credit Vehicle Bill of Sale is an instrument intended to provide a tax benefit to a seller. The seller must sell the old motor vehicle, buy a new one, and pay tax for the same. This bill of sale helps in earning a rebate on the tax payment for the new vehicle. However, the seller’s name must appear on the title of the previous vehicle. Refer to Act 1232 of 1997 and amended by Act 1047 of 2001 for provisions on such tax credits and the procedure to receive the credit. Please remember that a car dealer cannot claim such rebate in tax for selling a car owned by the other individual.

Things To Remember Before Proceeding

- Both the seller and the buyer must sign bill of sale for seller’s entitlement for tax credit

- Seller’s name must appear on the title of the vehicle for eligibility for tax credit

- Any individual, organization, association, or business can apply for tax credit

- The seller has maximum 45 days to use tax credit from the date of sale of the motor vehicle

- Claim such tax credit at the local Revenue Office while registering the new vehicle; however, you must produce a copy of this bill of sale during the registration

Contact Department of Finance and Administration Revenue Division office for more information on required documentation and procedure to claim tax credit

How To Write: Arkansas Tax Credit Vehicle Bill of Sale

- Enter buyer’s name

- Provide phone number of the buyer

- Then specify detailed address of the buyer including the zip code in Arkansas State

- Enter seller’s name

- Enter contact number for the seller

- Then provide detailed address of the seller

- Provide description of the motor vehicle like year of manufacturing, model, make

- Then enter VIN or vehicle identification number

- Provide odometer reading

- Enter date of selling the vehicle

- Then specify total sale amount

- The buyer must date and sign the bill of sale

- The seller must date and sign the bill of sale

Free Arkansas Tax Credit Vehicle Bill of Sale - PDF Download

Prepare Arkansas Tax Credit Vehicle Bill of Sale pursuant to Act 1232 of 1997 and amended by Act 1047 of 2001. Moreover, this bill of sale is necessary to provide documentary evidence of a sale of a motor vehicle and subsequent eligibility for the tax credit during the registration of the new vehicle. However, make sure that the seller and the buyer sign this form for seller’s entitlement to tax credit benefit. In addition, the seller’s name must appear on the title of the vehicle sold.