Table of Contents

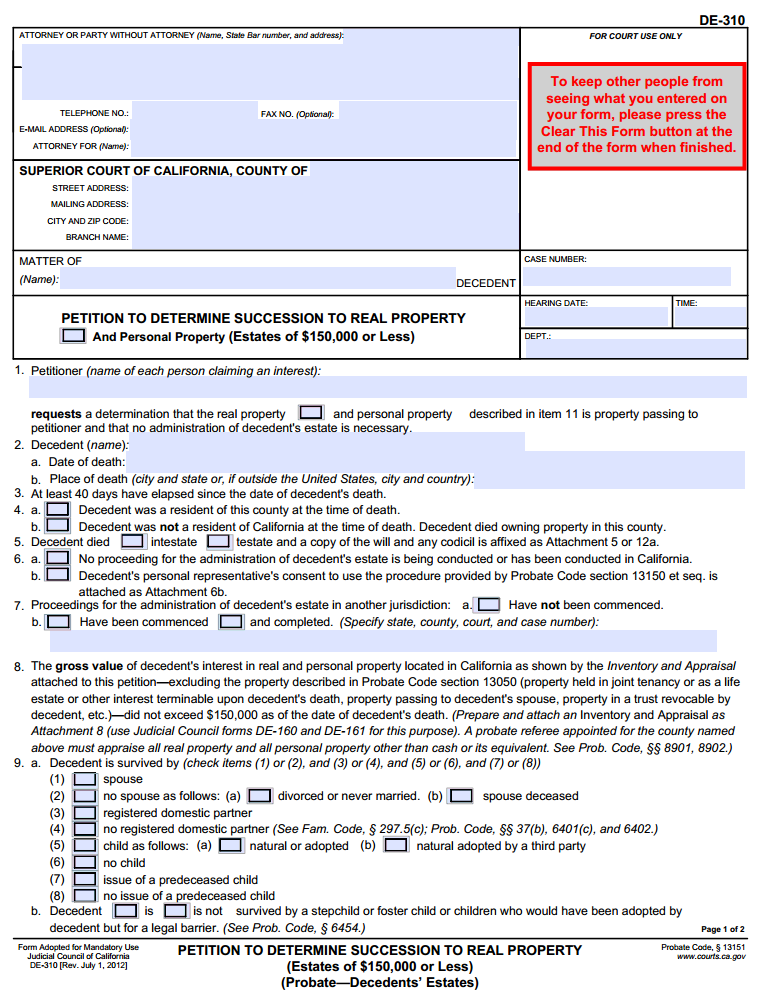

The Petition to Determine Succession to Real Property and Personal Property of Estates under $150,000 is regulated in the State of California pursuant to the Probate Code § 13150 – § 13158.

This petition is used to determine the dead person’s (decedent’s) estate, to identify the legal heirs and to correctly and legally transfers all rightful property to the correct person. This petition will be confirmed by oath, declaration or affirmation and can be used as evidence within a court.

This Petition enables the people who are entitled to the decedent’s Real Property and Personal Property up to $150,000. The form must be filled in correctly and you must take it to the person or organization holding the property so it can be officially dated, signed and stamped and the agent will have the power to transfer the property.

This Petition will entitle you to real property, personal property and payments of all money that is owed to the decedent and provide you legal claim to all of their tangible personal belongings. Once you receive their belongings, you will be held accountable for them and to any other person who has superior right. A person with superior right would be the money left to be paid to a bank for a loan on a vehicle, these kind of rights still remain intact.

What is Real Property?

Personal property includes items such as land, or a home.

What is Personal Property?

This includes all the decedents tangible assets, such as all his belongings and his vehicle. You may have to petition to the court for certain Personal Properties. Legislation sets out the legal limitations to what is and what isn’t Personal Property. The maximum limits are as follows; Property Owned with a total value not exceeding $150,000.

When can I use this Petition?

This type of Affidavit can only be used 40 Days since the death of the decedent.

How to Write

Filling in this document requires you to fill details in 10 individual boxes,

- Box 1. Firstly, please write your Attorney’s name, State Bar number and address. If you are without an Attorney, you should fill in your Name and Address

- Box 2. The Street Address, Mailing Address, City and Zip Code and Branch Name for either your Attorney, or your information if you are without one should be written here.

- Box 3. Please complete with the name of the relevant Superior Court of the California County.

- Box 4. Please fill in the full name of all Decedent

- Box 5. Please look up and write your Case Number, if you do not have one leave blank for now.

- Box 6. The Hearing Date & Time and the Department is required in this box, if you do not have these details leave blank for now.

Section 1

- You should fill in here the name of the Successor, as well as checking the box if this matter relates to: Real Property and/or Personal Property. Please see above guidance for further clarity.

- You should fill in here the name of the Decedent, the Date of Death and the Place of Death (City and State, or if outside of country, City and Country)

- Not applicable.

- You must check one of the 2 boxes depending on if the place of death was the decedents California residence or if he was not a resident of California but died owning property in the relevant county.

- You must check the relevant box and also keep with you a copy of the Will.

- (a) You must check the relevant box confirming that no proceeds for the administration of the Decedent’s have been already authorized and conducted.

(b) That the Decedents personal representatives consent to use the procedure provide by the Probate Code.

- You must check the relevant box to confirm that the estate has (a) not be already conducted, (b) it has already begun, (c) it has been completed. If relevant, you must specify the State, County, Court and Case Number.

- Not applicable.

- You must check the correct box based on whom survived the Decadent. Check items (1) or (2), and (3) or (4), and (5) or (6) and (7) or (8)

- Box 8. You must fill in the name of the Decent in addition to the Case Number

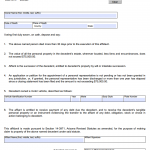

Section 2

- You must check the correct box depending on whom if someone survived the Decedent; also specify whether it is; parent/parents, brother/sister, other heirs or unknown next of kin.

- You must check this box if there is Real Property at hand. (Please see above guidance)

- This section you must choose 1 of the 2 boxes. Either (a) in which the Successor is named in the decedent will, or (b) if the Successor is natural occurring by law, which could be due to a lack of a will.

- You should fill in a short, concise description of the property that will be transferred, adjacent to the name of the correct Successor. If needed, this can take the form of a separate, attached document. (This could include, deposits, contents of safety deposit boxes at banks, etc., all tangible personal property, any instruments evidencing a debt, obligation, stock, stoke brand or any pending legal action and all other types of personal property)

- Not applicable.

- You should list the names and addresses of all persons named as executors in the decedent’s will.

- You should check this box if the Petitioner (the person this document relates to) is the Trustee as stated by the decedent’s will.

- You must fill in the box to specify if the Decedent’s estate was under a guardianship or conservatorship. Also provide the names and addresses of all persons serving as a guardian or conservator.

- You must fill in the number of pages you have attached to this document.

- Box 9. This section is for your Attorney to fill in.

- Box 10. This is the section you must date, print your name and sign, this states that the above information is true and will hold it legally binding.

Things to Remember

- Once you complete the Petition, you must personally take it to your Attorney, person or organization holding the property so it can be officially dated, signed and stamped and the agent will have the power to transfer the property. There may be a charge.

- When you deliver the Petition, you should take with you a copy of the decedent’s death certificate with you.

- You should also keep a copy of the Will with these documents.

- You will need to check the all relevant bodies for items that need registration or licence, such as vehicles.

- You cannot use this Petition if there is an application or petition for a personal representative of the decedent’s estate. (Pending or Granted) A personal representative is someone who has been officially named / given the legal power to handle the decedent’s estate.

- You cannot use this Petition if there is a legal action or proceedings involved regarding the estate.

If you are receiving property on behalf of another, you become an agent along with the duties of an agent under California Law.