Table of Contents

The Small Estate Affidavit(s) for Transfer of Property When a Person has Died, under $100,000 and up to $5000 in wages, is regulated in the State of Arizona pursuant to the A.R.S, § 14-3971.

A successor is the person(s) who is are entitled to the decedent’s property, a person with a legal right or legal standing. The successor is usually named in the will or if not it could fall on the Surviving Spouse, Child, Parents, Brother, Sister, etc.

The successor is entitled to the recently deceased Real Property and Personal Property, with certain limitation. Only Successors are entitled to fill in this form.

This Affidavit enables the people who are entitled to the decedent’s Real Property and Personal Property of up to a combined amount of $150,000.

What is Real Property?

Personal property includes items such as land, home, permanent structures on land, or wage. You must ensure that the amount of the real property does NOT exceed $100,000, and at least 6 months have passed since the death. For wages specifically, as the surviving spouse you can collect up to $5000 in wages owed to the deceased.

What is Personal Property?

This includes all the decedent’s tangible assets. Legislation sets out the legal limitations to what is and what isn’t Personal Property, such as all his belongings, cash, bank accounts, stocks, jewellery etc. but this does not vehicle which requires another form. You may have to petition to the court for certain Personal Properties. The maximum value of all Personal Property must NOT Exceed $75,000.

When can I use the Arizona Small Estate Affidavit?

This type of Affidavit can only be used 30 Days since the death of the decedent.

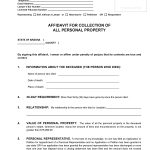

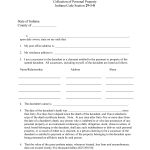

How to Write

- Box 1. Please write the name of the Person Filing this document. (Note: Box’s 2-7 are all in relation to this person.)

- Box 2. Please fill in the Street Address, unless it is protected.

- Box 3. In addition to filling in the City, State and Zip Code.

- Box 4. In this box your contact number / telephone number is required.

- Box 5. Please fill in your E-mail address, if you have one.

- Box 6. If using a lawyer, please write the Lawyer’s Bar Number.

- Box 7. The Licensed Fiduciary Number is required in this box, this is the person helping to manage the personal finances, health matters, etc., they should be able to assist you with this part.

- Box 8. You should check the relevant box depending on whether you are; Representing yourself, have an Attorney / Lawyer, have a Petitioner or have a Respondent. You should contact this person if you are not sure of their official role in this matter.

- Box 9. Please complete the relevant State of Arizona County

Section 1

- You should fill in here the name of the Decedent, the Date of Death and the Place of Death (City and State, or if outside of country, City and Country)

- Not applicable.

- You must describe the relationship with the person who died, with a short explanation if needed.

- Not applicable.

- Not applicable.

- Entitlement – You are stating here that you are the Successor and you must place a check next to all the relevant statements below.

- Description of Property – You write a description of the property, it’s value and its location / who has the property now. Do not feel limited to the few spaces on the form as you can attach as many additional documents as needed to this affidavit. Do not forget to put the Total Value at the bottom.

- Money Used – If the person who has died was entitled to some sort of funds, wage, or debt from a person in Arizona, you must describe this, state the amount and the name of the person / company who owes the debt. Do not feel limited to the few spaces on the form as you can attach as many additional documents as needed to this affidavit. Do not forget to put the Total Value at the bottom.

- Not applicable.

Oath or affirmation

The person making the Affidavit is require to sign, print their name, state, county, who it was subscribed / sworn before and the dates. The person who it was subscribed / sworn before is usually the Notary.

Always Remember

- If there are people with equal rights, they must all assign their interests in the estate to you using a legally signed document / Affidavit.

- Once you complete the Petition, you must personally take it to your Attorney, person or organization holding the property so it can be officially dated, signed and stamped and the agent will have the power to transfer the property. There may be a charge.

- You must attach a copy of the decedent’s death certificate to this Affidavit.

- You will need to check the all relevant bodies for items that need registration or licence, such as vehicles.

- You cannot use this Petition if there is an application or petition for a personal representative of the decedent’s estate. (Pending or Granted) A personal representative is someone who has been officially named / given the legal power to handle the decedent’s estate.

- You cannot use this Petition if there is a legal action or proceedings involved regarding the estate.

- If you are receiving property on behalf of another, you become an agent along with the duties of an agent under Arizona law.