Table of Contents

The Illinois Small Estate Affidavit Form is pursuant to the Illinois Probate Act of 1975, section 25-1. It can be used when the deceased’s estate is worth less than $100,000 and there are no claims on the estate or debts other than funeral expenses.

When can I use this Affidavit?

- The total amount of personal property in the estate of the decedent is worth $100,000 or less;

- The decedent did not own any real estate.

- If the decedent had a will, a copy of that Will has to be filled with the probate court in the county where the decedent resided during his / her death within 30 days of the death.

- The probate code should not have issued any “letters of office”

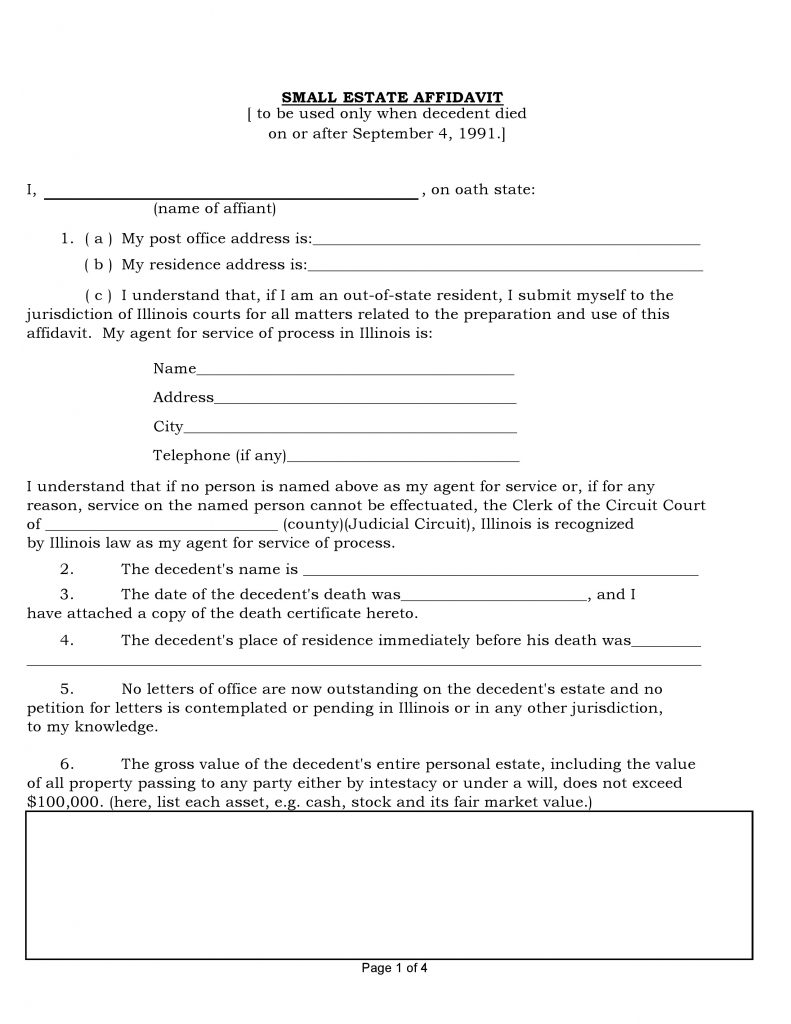

How to Write

- This form can be filled out online except for the signature. If you are not able to do so, you may print it and fill it out with a pen.

- Enter your name.

- Enter your mailing address.

- Enter your residence address (this may be the same).

- If you do not live in Illinois, enter the name and address of someone who can accept service of court papers. If you do not enter an agent of service, enter the name of the county or circuit court and the court clerk will accept service.

- Enter the name of the deceased.

- Enter the date of death.

- Enter all assets of the deceased.

- If funeral expenses are still owed, enter the name and address of the people owed.

- If the deceased has a surviving spouse, minor children, or adult dependent children, enter their names, relationships, addresses, and ages.

- If the deceased has a surviving spouse, calculate the award owed to the surviving spouse and any minor or adult dependent children who live with him or her.

- If the deceased has no surviving spouse but does have minor or adult dependent children, calculate the award owed to them.

- If the deceased had no will, enter the name, address, relationship, age, and portion of the estate owed by law for each of the heirs.

- If the deceased had a will, enter the name, address, relationship, age, and portion of the estate specified for the heirs.

- Enter the proposed division of assets.

- Enter your name, address, and phone number.

- Print and sign the affidavit.

- Attach a copy of the death certificate and of the will (if there was a will).

Present this affidavit to the person, bank, corporation, or entity who is currently in possession of the assets in order to claim your share.

What else Do I need?

- You need to have a copy of the death certificate and the certified copy of the will (if the decedent had a will).